I found a very interesting blog where this cloud-based software is demonstrated. Specifically, someone (anonymous) did a very interesting simulation about Dell's supply chain and they did it in 2 days. I am posting a little bit about the results of this simulation but in the original post is more detailed information about how the simulation was done over those 48 hours. Also, if you're interested, at the end of the article, I left more information about Operational Cloning.

Operational Cloning is a cloud-based supply chain and logistics software that improves supply chain change management and risk management by creating virtual copies, or clones, of your supply chain that help you design, experiment with and communicate change before it is implemented. As a self-serve process, you stay in control at all times. Alternatively we can structure it as a supply chain consulting or logistics consulting service.

Recently OperationalCloning was tested by modelling Dell Inc’s large global network and examining the impact of change on it. It was done in two days.

Operational Cloning is a cloud-based supply chain and logistics software that improves supply chain change management and risk management by creating virtual copies, or clones, of your supply chain that help you design, experiment with and communicate change before it is implemented. As a self-serve process, you stay in control at all times. Alternatively we can structure it as a supply chain consulting or logistics consulting service.

How I cloned Dell’s finished goods supply chain

Recently OperationalCloning was tested by modelling Dell Inc’s large global network and examining the impact of change on it. It was done in two days.

OperationalCloning was intended to put large, complex supply chain and logistics change projects within reach of

individuals and smaller working groups by giving them the power to know the

network and to design change in a way they couldn’t before.

Dell as a natural choice for this test

simulation Dell is famous for its configure-to-order approach that

relies on air freight to maintain competitive service levels. Configure-to-order

is highly sensitive to the volatility of fuel prices and product prices –

something that Dell has seen plenty of in recent years. Modeling Dell’s

global network allowed looking at the sensitivity of its supply chain to these changes

using OperationalCloning.

What the results showed straight away about

Dell’s finished goods supply chain

- Dell’s supply chain costs (expressed as a percentage of revenue) will increase — “Sweet spots” in terms of the average value density of a product range in relation to external cost factors do exist in time (or it is possible to get lucky). Put another way, it is likely that Dell’s total supply chain cost expressed as a percentage of revenue will increase regardless of the preventative steps it takes.

- The tipping point that forces a complete shift from configure-to-order is years away – The tipping point where a significant shift away from configure-to-order is mandated by external factors is potentially years away and will most likely only apply to lower cost product families and servicing non-domestic markets (assuming that US domestic manufacturing remains as is).

- Inventory carry cost will remain dominant – When considering supply chain design changes, the dominant factors are still inventory carry cost and how the US domestic market is serviced. In addition, inventory carry cost is very sensitive to the average planning and purchasing frequency that results due to the planning strategy implemented.

You can explore the simulation results

on Google

Public Data Explorer.

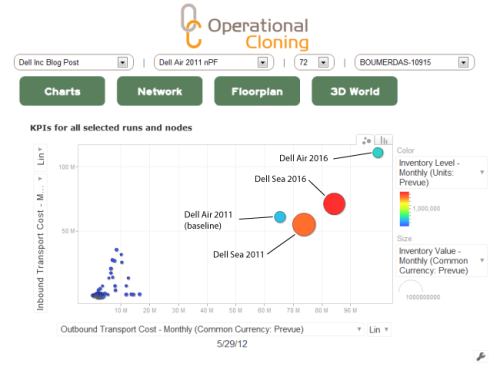

To compare one scenario with another, The transportation costs and the

estimated inventory carry costs (using 18% of inventory value)were added, and divided by

the total revenue for the scenario.

-

DNA Scenario Revenue(monthly in $millions) Inbound Transport(monthly in $millions) Outbound Transport(monthly in $millions) InventoryValue(monthly in $millions) (Transport +Inventory Carry)/Revenue as % 2011 Air (Baseline) 3790 61.3 65.2 83.9 3.74% 2016 Air 3184 111.4 99.6 67.2 7.01% 2011 Sea 3755 55.2 74.3 1967 12.88% 2016 Sea 3341 71.2 84.8 1769 14.20%

The summary results were examined, taking into account that:

- the global transportation rates and services used in this simulation are hypothetical

- the actual result values should only be interpreted in terms of comparative ratios and trends across scenarios

- while an “all or nothing” approach to choosing an inbound mode of transport and inventory planning strategy is a simplification, it helps with understanding the trade-offs in the approaches and its impact on designing the network.

The Dell Inc summary details used to compile

the DNA

| Revenue | Headquartered in Round Rock, Texas, Dell Inc’s 2011 revenue was $50,002 million. To simplify things I ignored software and peripherals reported at $10,261 million, reducing the 2011 revenue to $39,741 million. 52% of the revenue is domestic. |

| Distribution | Dell distributes to 180 countries, which I reduced to 160 for this test simulation. I guessed that Dell distributes from about 45 countries. |

| Product families | I collapsed the Dell product families to: (i) servers and networking; (ii) storage; (iii) mobility; and (iv) desktop PCs. I estimated the total number of SKUs in these product families at about 650. |

| SKU parameters I assumed | Average purchase price across product families: $915 with a minimum to maximum range of $250 to $60,000.Average unit weight across product families: 4 kg with a minimum to maximum range of 1.8 to 40 kg.Average unit volume across product families: 6000 cm3 with a minimum to maximum range of 2000 cm3 to 70,000 cm3. The average gross margin across product families: 0.14 with a minimum to maximum range of 0.06 to 0.30. |

| Average order value | I assumed an average order value across the network as $1,400. |

| Revenue groupings and order profile | Dell reports segment revenue by grouping large enterprise, public, small and medium business and consumer. For this test simulation I grouped the large enterprise and public as order class A, small and medium business as order class B and consumer as class C. Given this grouping, the order class demand proportions for A, B and C are 56, 24 and 20 percent. Order class A subclass demand proportions are 51 and 49 percent, with the average lines ordered per subclass 6 and 15. Order class B subclass demand proportions are 50, 35 and 15 with the average lines ordered per subclass 14, 10 and 5. Order class C subclass demand proportions are a 100 percent with the average lines ordered per subclass 2. |

| Primary points of supply | Given the scope of this test simulation, Dell has 6 primary points of supply located in North America, South East Asia, East Asia, South America, South Asia and Eastern Europe. |

Operational Cloning is a cloud-based supply chain and logistics software

that improves supply chain change management and risk management by

creating virtual copies, or clones, of your supply chain that help you

design, experiment with and communicate change before it is implemented.

As a self-serve process, you stay in control at all times.

Alternatively we can structure it as a supply chain consulting or

logistics consulting service.

Operational Cloning builds a strong bridge between the changes you design and their ultimate implemention. It creates a single, integrated supply chain simulation and logistics simulation of your global purchasing, distribution and transportation plans.

Reduce the uncertainty inherent in you supply chain strategy and distribution strategy.

Your supply chain strategy and distribution strategy is by definition uncertain and incomplete. OperationalCloningTM offers a competitive advantage. It quickly reduces the uncertainty inherent in supply chain decisions by allowing you to test the decisions through simulation. It is a cloud-based supply chain simulation and logistics simulation service, that you can use for specific projects or as an enterprise process. It works for supply network, distribution network and distribution center design, planning and simulation.

References:

Operational Cloning builds a strong bridge between the changes you design and their ultimate implemention. It creates a single, integrated supply chain simulation and logistics simulation of your global purchasing, distribution and transportation plans.

Reduce the uncertainty inherent in you supply chain strategy and distribution strategy.

Your supply chain strategy and distribution strategy is by definition uncertain and incomplete. OperationalCloningTM offers a competitive advantage. It quickly reduces the uncertainty inherent in supply chain decisions by allowing you to test the decisions through simulation. It is a cloud-based supply chain simulation and logistics simulation service, that you can use for specific projects or as an enterprise process. It works for supply network, distribution network and distribution center design, planning and simulation.

References:

Ocsimulation. (May 30, 2012). How I cloned Dell’s finished goods supply chain in under 48 hours. Operational Cloning Blog. Retrieved 09/11/2012. Available at: http://ocsimulation.wordpress.com/2012/05/30/how-i-cloned-dells-finished-goods-supply-chain-in-under-48-hours/

Thank you for sharing very informatics and useful post on finished goods....

ReplyDeleteTurbo Invoice Validation Portal