Rising pressure from globalization and competition, high consumer

expectations, and increasingly complex patterns of customer demand are some of

the challenges almost every organization face. According to a survey conducted

by McKinsey, around 66 % of the organizations expect supply chain risk to

increase in the upcoming years. A highlighting issue that has come up as a part

of this survey is the kind of rough path and the struggles associated with the

processes and capabilities of the supply chain management. An insight to the

challenges which will be confronted by the organizations in the world is

discussed below:

Emergence from the Economic Downturn

From the history of the market in the past few years, the major

concern for all the companies was monetary constraints. The volatility of customer

demand as a result of financial crises affected the markets across the globe.

However for the upcoming years, globalization and environmental concern remains

as one of the top priority for a huge number of organizations. The share that

identify environmental concerns as a top challenge in the next five years

nearly doubled, to 21 percent. This is also a form of indication that the

companies are emerging from the economic downturn and financial affairs are not

the only source of concerns. The companies are returning to a normal mode of

operation with new types of challenges ahead.

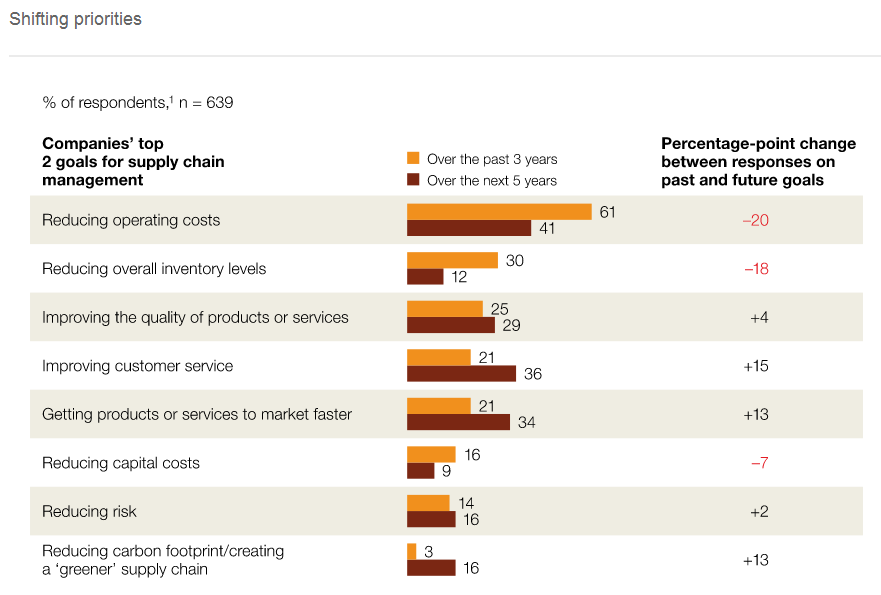

Shifting priority

Majority

of the companies are meeting the goals and targets they set for themselves as a

result of improved efficiency and performance. Nearly 50 % of the companies who

participated in the McKinsey survey assert that their companies’ service levels

are higher now than they were three years ago, 39 % say costs as a percentage

of sales are lower, and 45 % have better managed inventories.

Even

after all these improvements the matter of concern is the amount of supply chain

risks. More than 66 % of the companies believe that the risk increased in the

past three years, they dealt with it but nearly the same amount of risk will

continue to rise. So there is a continuous shift in the priorities of customers

which in turn is creating a whole new set of risks for the market.

Managing challenges and trade-offs

While

the business conditions in the next few years seem favorable from the strategic

goals set by the executives, the company as a whole is not entirely ready to

adapt to the challenges. The small and the large companies are on the same page

when we talk about readiness to face the challenges. However, one good news is

that the three major challenges namely global competition, rising consumer

expectations, and complex patterns of customer demand; a majority of the

organizations are prepared to meet these challenges. The problem arises due to

lesser involvement of the executives. They fail to understand the functional

trade-offs related to these challenges and assumes that their companies are ready

to face them.

The Fragmented Processes

Around

31% - 40% of the participating firms face the issue that their operations teams

and sales team are never on the same platform or that they never meet to

discuss the strategies and issues related to the supply chain. Similarly there

are many more processes within the firms which are not collaborated well with

the others. 23% of the firms cite problem between their IT and manufacturing, and

21 % between manufacturing and planning. This fragmentation is likely

exacerbated by the lower levels of CEO involvement. Majority of the CEOs do not

actively develop supply chain strategy or work hands-on to execute it. To avoid

cross functional disconnections, a higher level of CEO involvement will turn

out to be promising in resolving this issue.

Leveraging the Information

In the world of Big Data and Predictive

Analysis, some companies fail to collect and connect enough data in making wise

decisions related to supply chain. For example, customer service is becoming a

higher priority, and executives say their companies balance service and cost to

serve effectively, yet companies are most likely to take a one-size-fits-all

approach when defining and managing service-level targets. On the other hand

while some of the companies use user data to enhance customer experience, they

have mediocre information about incremental costs for raw materials,

manufacturing capacity, and personnel.

While it is obvious that the supply

chain challenges in future will require companies to keep and use information

is more sophisticated ways, only 25% of the participating companies believe

that they will invest in IT systems over the next five years, and only 10 % of

respondents say their companies currently use social media to identify

customers’ service needs.

REFERENCES:

[1] http://www.mckinsey.com/insights/operations/the_challenges_ahead_for_supply_chains_mckinsey_global_survey_results

[2] https://supply-chain.org/top-supply-chain-challenges

[3] http://online.wsj.com/news/articles/SB10001424052702304549504579318120467741330

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.