“Just when thousands of manufacturers thought that

off- shoring a significant portion of their manufacturing and supply operations

has given them competitive parity, the game may be changing again.” [1]

We

have read in this week’s articles that factors that once made

offshoring activities attractive to companies like Dell and LG have now changed drastically and have eroded many of their savings. Dr. Patrick Dixon, in the

above video, also talks about some of the challenges that companies are facing due

to high inflation and soaring labor cost in India and China. It is becoming

very difficult for the companies to justify for their expensive costs incurred in

making offshoring activities efficient as the savings from these activities are

decreasing.

The Way Things

Were…

Earlier

suppliers in low cost countries like China could offer “perceived” prices 25 to

40% lower than those available onshore mainly because of cheap labor,

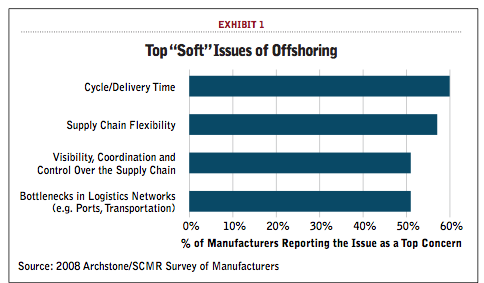

commodities and favorable exchange rates. Despite some soft issues (Exhibit 1)

related to offshoring like quality problems and bottlenecks in logistics

networks, most executives were ready to make the trade offs as the magnitude of

offshoring saving was much more than the cost of these soft issues.

The True Offshore Cost....

According

to a survey conducted by Archstone Consulting, more than 60% of the

manufacturers generally ignore cost elements that can increase their total offshoring cost by more than

20%. For instance - Only 19% of them include customer service

cost in their Total Cost Model (Exhibit 4). Hence, they generally see a

distorted picture of the related cost of different manufacturing options by

looking at just some of the easily available cost components.

The Wake-up Call...

However, the steep increase in the prices

of offshore labor and commodities every year has made the impact of numerous

soft costs painfully obvious to the manufacturers . They have reported significant increase in materials, logistics and transportation cost (Exhibit 2). From 2005

through 2008 alone, transportation charges for ocean freight and the global

commodity price index have increased by 135% and 27% respectively. The Chinese

Yuan has increased by 18% in value compared to the U.S. Dollar and Chinese

manufacturing wages have also increased by 44%.

Executives are now more concerned about

their inability to provide customized services, cost of shipping products for

remanufacturing, need for extra warehousing due to offshoring. The combined

cost of the changes in global environment and the soft issues has made offshoring activities less appealing to the

manufacturers. According to the article by John Ferreira and Len Prokopets from

Archstone Consulting, several economists feel that the long-term trend line is

pointing towards two developments:

- U.S. and some near manufacturing sources will re-emerge as potential supply markets.

- Local U.S. supply market may regain some of the lost businesses due to offshoring in recent years.

The

survey reveals that nearly 90% of the manufacturers are now changing their

manufacturing and supply chain strategies. Migration of their operations to

U.S. will not only help them in reducing their offshoring cost but will also

enable to deal with soft issues effectively like marketing strategies, product

development, meeting customer expectations, responsiveness and not just low

cost.

However, the

biggest challenge is that would these companies be able to find the manufacturing

infrastructure, skilled workforce and supplier networks required for their

operation in U.S.? Would they be able to re-establish their operation

capabilities that had been outsourced? How much time would it take them to rebalance

their manufacturing and supply networks after shifting them from offshore to U.S. or near-shore manufacturing sources?

The

migration of manufacturing processes offshore has lead to a significant decline

in the local manufacturing infrastructure, technical

workforce and maintenance workers in U.S. over the years. Many supply networks have also

disappeared. Therefore, re-establishing manufacturing footprint in the U.S. is

one of the biggest challenges for the companies. It will take a lot of time,

investment and commitment to rebuild everything.

References

[1] http://www.areadevelopment.com/article_pdf/id44472_does-offshoring-still-make-sense.pdf

[2] http://www.businessweek.com/stories/2008-06-18/can-the-u-dot-s-dot-bring-jobs-back-from-china

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.